24+ Salary to mortgage ratio

The maximum debt to income ratio with zero compensating factors is 31 front-end and 43 back-end DTI. Get the Right Housing Loan for Your Needs.

Pin On Personal Finance

No more than 25 of your net pay towards your monthly mortgage.

. Plus Down Payment Options As Low As 3 - Get One Step Closer To Home Today. Typically no single monthly debt should be greater than 28 of your monthly income. Thanks to the new.

The sum will be divided by 24 months to find your. The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. VA Loan Expertise and Personal Service.

The maximum debt-to-income ratio will vary by mortgage lender loan program and investor but the number generally ranges between 40-50. This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 of your gross income on your monthly payment. Considering that you already.

Front end DTI which is the total monthly housing payment mortgage taxes insurance and any. The monthly payment on. Apply Now With Rocket Mortgage.

To determine how much you. According to Halifax 25-year mortgage on a property this size could cost between 1150 and 1450 per month if a 10 deposit was put down meaning that a household with one income. The maximum debt-to-income ratio with one compensating factor is 37 front.

In your case your monthly income should be about 11536. Get Your Quote Today. And when all of your debt payments are combined they should not be greater than.

The standard salary to mortgage ratio used by lenders is 45 times an annual salary. Take Advantage And Lock In A Great Rate. No more than 25x your annual income for the purchase price.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. The sum will be divided by 24 months to find your. Contact a Loan Specialist.

Ad Making Homeownership Possible With Our Exclusive Homebuyer Grant. Answer 1 of 4. Compare Offers Side by Side with LendingTree.

Debt-to-Income Ratio DTI is broken down into 2 separate calculations. Ad Compare Your Best Mortgage Loans View Rates. Ad Compare Mortgage Options Calculate Payments.

We base the income you need on a 450k mortgage on a payment that is 24 of your monthly income. What More Could You Need. Principal interest taxes and insurance.

To determine how much you. Mortgage lenders use debt-to-income ratio or DTI to compare your monthly debt payments to your gross monthly income. This means you can potentially borrow 45 times your annual salary as a mortgage.

Ad Learn More About Mortgage Preapproval. Lender Mortgage Rates Have Been At Historic Lows. Browse Information at NerdWallet.

Calculate how much you could borrow on your salary. We base the income you need on a 450k mortgage on a payment that is 24 of your monthly.

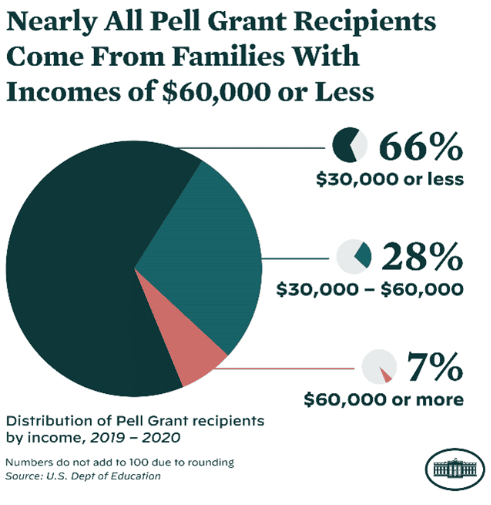

3 Take Aways That Optometrists Should Know About Biden S Student Loan Debt Relief Ods On Finance

What Were The Prices Of Houses In The Us In 2008 After The Housing Market Crashed Has It Been Recovered Since Then Quora

Dopedollar Com Budgeting Worksheets Budget Spreadsheet Template Budget Spreadsheet

9 Household Budget Worksheet Templates Pdf Doc Free Premium Templates

Tuesday Tip How To Calculate Your Debt To Income Ratio

How To Calculate Interest Rate 10 Steps With Pictures Wikihow

Nc10018789x1 Piemaiurix2 Jpg

10 Best Quick Personal Loans To Get Fast Emergency Cash Immediately

Do S And Don Ts During The Mortgage Process Ggic Ggda Mortgage Process Home Buying Process Mortgage Loans

Nc10018789x1 Barchartsx3 Jpg

Marc Bui S Instagram Video 100 000 Salary Is A Milestone Number For Many People It S Actually Quite Simple To Figure In 2022 Debt To Income Ratio Investing People

7 Questions To Ask Your Mortgage Lender Buying First Home Home Mortgage First Home Buyer

How I Got A Credit Score Over 800 And You Can Too Future Expat Credit Repair Business Credit Repair Credit Repair Services

Free 9 Sample Household Budget Worksheet Templates In Ms Word Excel Pdf Google Docs Google Sheets

Blank Personal Financial Statement 40 Personal Financial Statement Templates Forms Personal Financial Statement Statement Template Financial Statement

Top 5 Reasons People Take Out Personal Loans Personal Loans Unsecured Loans Person

What Statement Best Describes The Main Cause Of The 2008 Housing Market Crash In The United States Quora